tax payment forgiveness program

If we have a debt with the IRS and cannot make the corresponding payment we can receive fines and penalties. The IRS has the final say on whether you qualify for debt forgiveness.

Income Driven Repayment Options

In Indiana for example the state tax rate is 323.

. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. However if we have a valid reason for not making the. Provides a reduction in tax liability and Forgives.

Usually its in a taxpayers best interest to seek a forgiveness program if they believe they owe several thousand in back taxes and cannot make the monthly minimum payments on an. Child Tax Credit The 2021 Child Tax Credit is up to 3600 for each qualifying child. One IRS tax forgiveness program also known as an offer in compromise comes with a long list of benefits.

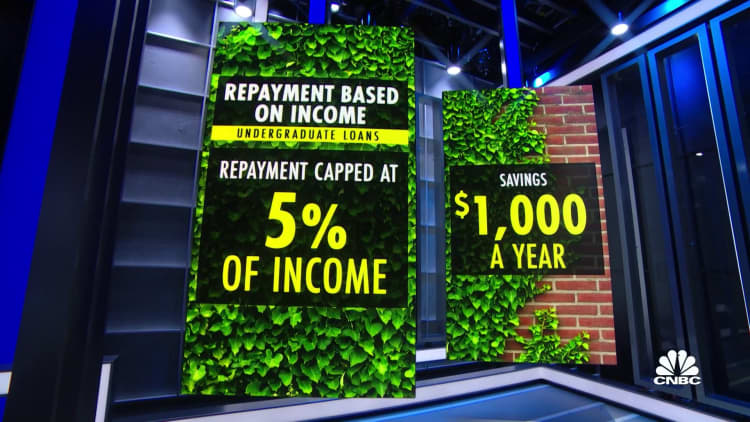

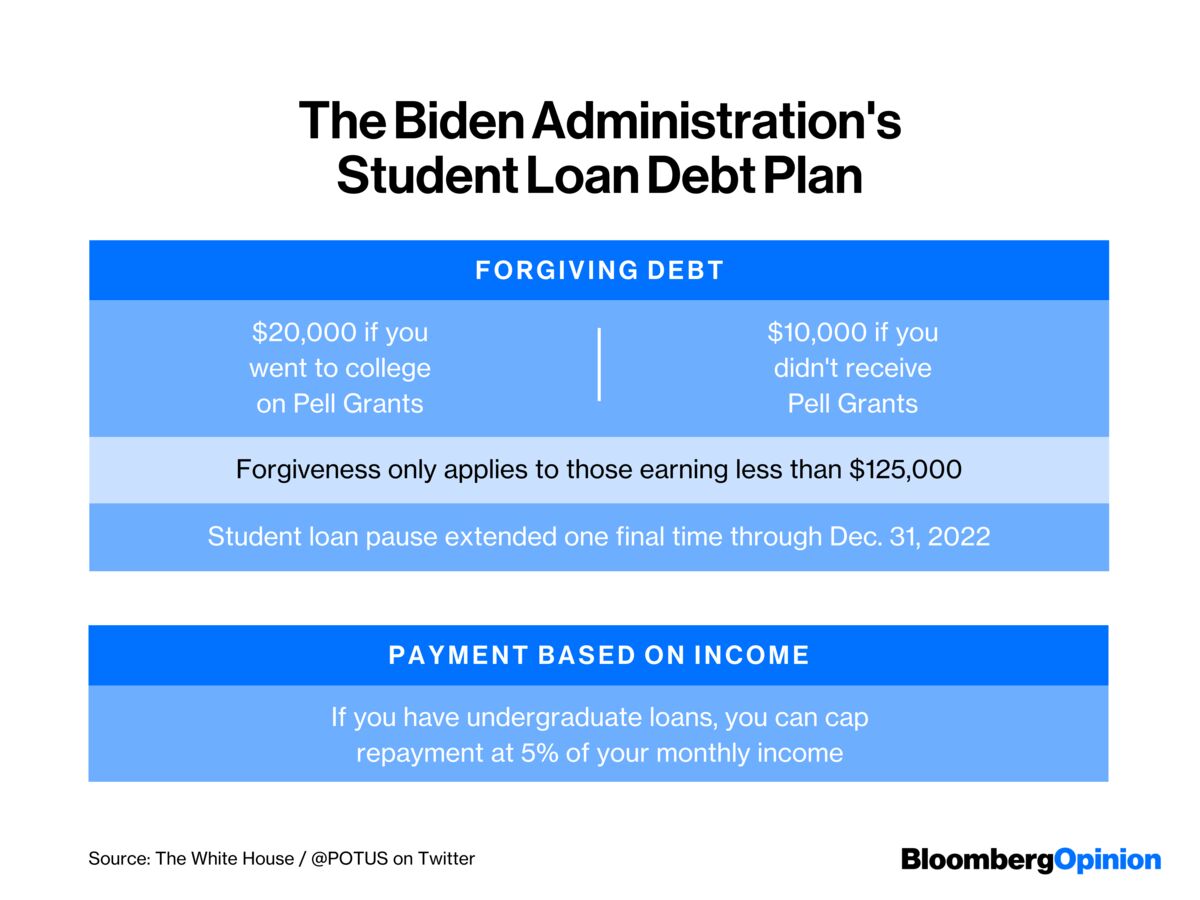

Allows you to pay no more than 5 of your discretionary income monthly on undergraduate loans. IRS Tax Debt Forgiveness Program Definition. A payment program providing easier alternatives for taxpayers fraught with taxes and debts beyond their means.

Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples. In general though the agency looks for taxpayers who. If you pursue certain payment.

Raises the amount of whats considered non-discretionary income. Your tax balance needs to be below 50000 for you to be able to qualify for a tax forgiveness program. You can also apply for the IRS.

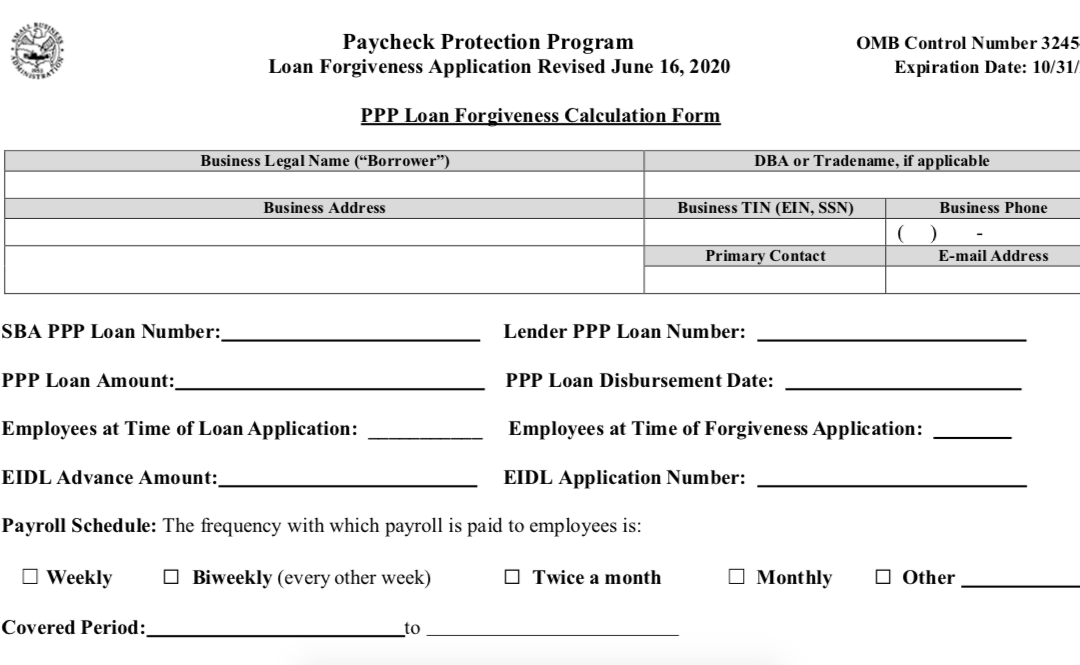

Form 656 s you must submit individual and business tax debt Corporation LLC Partnership on separate Forms 656 205 application fee non-refundable Initial payment. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Generally if you borrow money from a commercial lender and the.

Some of the biggest perks include. Agree to a direct payment installment forgiveness Earn less than 100001 200001 for joint taxpayers Owe less than 50000 at the time of application. Furthermore you cant have more than 100000 in income if you are filing alone and.

For individual taxpayers receiving notices letters about a tax bill with tax liabilities up to 250000 for Tax Year 2019 only the IRS can offer one Installment Agreement. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. Department of Education requires you to make 120 qualifying monthly payments or 10 years of payments.

A total tax debt balance of 50000 or below. The Mayors Office and Department of Finance is offering a late fee forgiveness or amnesty program for residents to take advantage of from October 1 until December 31 2022. The Public Service Loan Forgiveness PSLF program through the US.

IRS debt relief is for those with a debt of 50000 or less. Eligible families including families in Puerto Rico who dont owe taxes to the IRS can claim the credit. COVID Penalty Relief To help taxpayers affected by the COVID pandemic were issuing automatic refunds or credits for failure to file penalties for certain 2019 and 2020.

What 10 000 In Student Loan Forgiveness Means For Your Tax Bill Fortune

Back Tax Blog Keith Jones Cpa Trusted Tax Relief Company

Report Says Some States Could Tax Student Debt Forgiveness

Student Loans Who Can Pay Taxes On Forgiven Debt Marca

Irs Payment Plan Everything You Need To Know Community Tax

Understanding The Tax Implications Of Student Debt Forgiveness Urban Institute

Tax Relief Questions And Answers Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What Is The Irs Debt Forgiveness Program Tax Defense Network

Calameo Three Ways To Settle Or Resolve Your Tax Debt Advance Tax Relief

The Impact Of Filing Status On Student Loan Repayment Plans The Tax Adviser

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

Pay For Taxes Via Direct Pay Credit Card Or Payment Plan

Paying Taxes In 2022 What You Need To Know The New York Times

Owe The Irs 10k See If You Qualify For Irs Tax Forgiveness Program

/1099-C-69a52b42698048d68609c2c79946530d.jpg)

Form 1099 C Cancellation Of Debt Definition And How To File

Federal Student Loan Forgiveness Indiana Will Tax Canceled Debt

Biden S Student Loan Forgiveness May Cost Taxpayers Prompt Inflation

New Stimulus Package Makes Student Loan Forgiveness Tax Free Student Loan Hero

Student Loan Forgiveness Biden Plan To Cancel Debt Is A Costly Mistake Bloomberg